If you get confused about Personal Tax matters and would like a simplified explanation of the major Tax issues that could affect your finances, then this article may be the right one for you. Supported by Chartered Accountants, we aim to give clarity on the topic of Tax, particularly for those that are self-employed.

What is Tax?

Tax is the monetary sum paid to a Government for funding fiscal policies. A fiscal policy is whereby the government manages revenue collection and expenses to stabilise the economy. Therefore, expenses and tax rates are adjusted to best suit economic conditions which are influenced by employment levels, inflation and the nation’s economic growth.

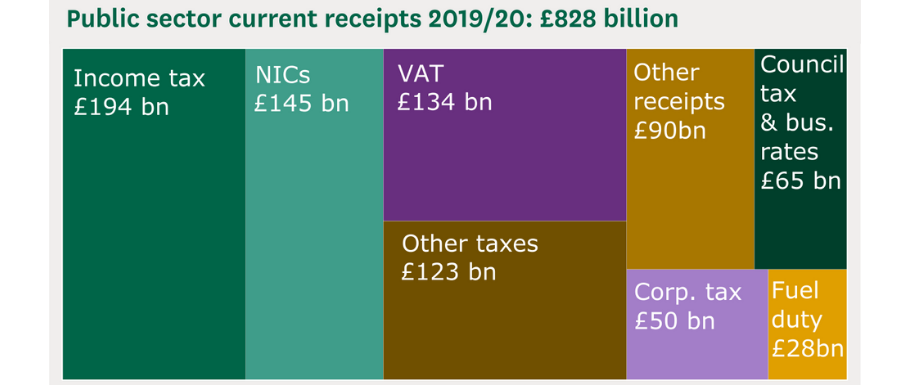

The different types of Tax (UK)

- Income Tax: Tax on people’s income

- National Insurance: Another type of Income-Tax that qualifies an individual for certain benefits and State Pension. This is usually paid from the age of 16 years to the state pension age1.

- Value-added Tax (VAT): Consumption Tax that you pay when you buy goods or services

- Excise Duties: Indirect Tax on products that cause damage to health (alcohol and tobacco), environment (fossil fuel) or mental health (gambling)2

- Corporation TAX: Tax on company profit. This Tax is paid by Limited Companies and foreign companies with offices in the UK.

- Stamp Duty: Tax on buying houses or shares

Image (1) courtesy of Pexels

Income Tax (UK)

For purposes of this article, tax derived from Income will be the primary focus. By observing image 2 it is clear to see, that Income Tax and National Insurance Contributions (NICs) add the largest sum of money to the Government fund. Therefore, it is important to understand the basic principals of Income Tax.

Image (2) courtesy of commonslibrary.parliament.uk

How much Income Tax do you pay?

The UK Income Tax structure is based on a ‘marginal rate system’ which means that as the individual’s income increases, the income-tax also increases. The marginal income tax bands vary according to the gross earnings. The Tax bands3 for the year 2020-2021 are as follows.

- 0% on income from £0 – £12,500

- 20% on income from £12,501 – £50,000

- 40% on income from £50,001 – £150,000

- 45% on income from £150,001+

Following the Budget announcement dated 3rd March 2021, adjustments have been made to the tax bands (see GOV.UK for the revised tax brackets).

Personal Tax Allowance

‘Personal Tax Allowance’ is the income that you do not have to pay tax on. Over the years, this amount has changed. At the time of writing, the value of tax-free income stands at £12,500 (Tax year 2020-2021). For the Tax year 2021-2022 this will increase to £12,570. Earnings over this value are taxed according to the marginal rate system. As an example, a person who earns a gross income of £30,000 in a year, pays no tax on the initial £12,500 (personal tax allowance for the tax year 2020-2021) and pays 20% tax on the remaining £17,500. A person with a higher salary, from £50,000 – £100,000, will have the same personal tax allowance, but pay the higher tax band. There is no personal tax allowance for a person who earns over £125,0004.

Why is Tax Important?

Taxes are paid to the HMRC (Her Majesty’s Revenue & Customs) to raise revenue for Government funds. In turn, this capital is spent on necessary public services such as the NHS (National Health Services), education, public transport, the welfare and social services, emergency aid (police, fire and ambulance services) and the country’s defence system. The government is responsible for managing the funds in the best interest of the nation5.

“HMRC will be looking to boost the public purse and replenish the pandemic funding. It is wise to be proactive with your tax planning”.

Keith Smith, GHLD Chartered Accountants

Image (3) courtesy of AtalianServest.co.uk

Employment Taxes (UK)

The term ‘employment taxes’ refers to a list of taxes associated with an employee. From the employee’s wage, an employer will pay the income tax and national insurance contributions, directly through the payroll system, known as the PAYE (Pay As You Earn)6 scheme. The HMRC use tax codes to determine how much tax an individual should be paying. This code is passed onto the employer. Emergency tax codes are issued when the employment status has recently changed or temporarily unverified7.

Another employment tax deduction is the ‘national insurance’ paid directly by the employer to the government, based on the employee’s salary and benefits. Therefore, employment taxes are paid by both, the employee (via PAYE) and the employer8.

Tax & Employee Benefits

Employee benefits can be taxable or tax-free depending on the nature of the benefit and its value. For a fully up-to-date and comprehensive index, visit GOV.UK – Tax on Company Benefits. The following list highlights the most commonly questioned criteria.

- Bonus and commission Schemes – Taxable

- Employer’s Pension Contribution – Tax-Free

- Company Shares & Incentives – Tax advantages as outlined by GOV.UK

- Company Car9 – Taxable

- Medical Insurance – Taxable

- Meals from a Staff Canteen – Tax-Free

- Hot drinks & Water at Work – Tax-Free

- Mobile Phone – Tax-Free

- Workplace Car Park – Tax-Free

- Bicycles & Cycling Equipment10 – Tax-Free

- Company Uniform – Tax-Free

- Holidays & Holiday Vouchers – Taxable

You pay Tax on the value of the benefit to you, which your employer works out.

Employed V’s Self-Employed

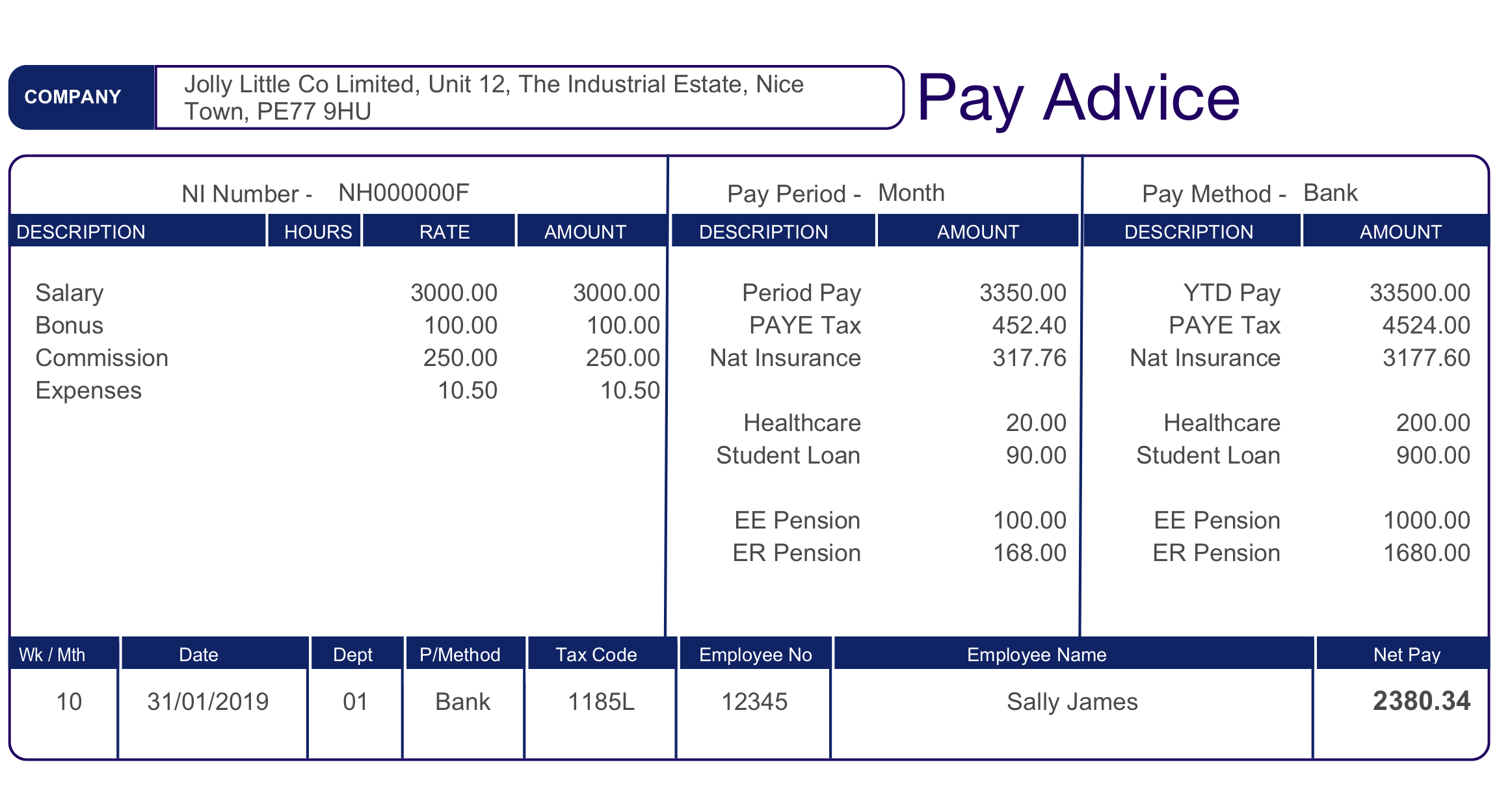

Employment is a contract between a business and an individual to complete work for a salary. A person who is employed directly through a company will have an employment contract outlining their hours of duty amongst other contractual obligations. The employee’s income tax and national insurance are paid automatically through the PAYE system. The tax calculation is done on their behalf by the employer and paid to the HMRC. Provided the employee has no other source of income, the entire tax calculation is done by the employer and the calculations can be checked on the monthly payslip (image 4).

Image (4) Sample Payslip – courtesy of os-payroll.co.uk

A self-employed person can perform the same duties as the company-employed member of staff but, they are employed as freelancers, on a short-term contract. The self-employed tradesperson will work days and hours as agreed with the end-client. Opticians are a prime example of skilled staff that can choose to work directly for a company or work for themselves as a locum, providing day to day freelance contracts for a multitude of companies as a self-employed member of staff.

Expenses and Taxes are, therefore, the responsibility of the self-employed persons to complete via a self-assessment form11. The self-employed person will have to invoice the employer, manage their own accounts & book-keeping and pay taxes directly to the HMRC. The self-employed person can use government tools to correctly calculate taxes or pay an accountant to do so. There is also a multitude of online applications to aid business accounting such as Clearbooks and QuickBooks.

What is the definition of ‘Business’?

When we explore the term ‘Business’, we are presented with various definitions through different sources. A dictionary, a lawyer and an accountant all describe the word ‘Business’ with a slight undertone of varying connotation. For example, the Oxford Dictionary says that a ‘Business’ is “a person’s regular occupation, profession or trade”. From a commerce perspective, a business is defined as the organised efforts to produce and sell ‘goods & services’ for profit12.

Is a Self-Employed person a Business?

The self-employed person or freelancer is a ‘business’, in essence, albeit a risky one. An ‘ideal’ business model would be where the business continues to operate and produce profit without the sole effort of the business owner. For example, a restaurant does not cease trading if the owner is not present. The business continues to operate and make a profit whilst the proprietor may be on holiday.

As a self-employed person whose trade depends on their sole efforts to produce goods or services is a big risk. Should the sole-trader become ill, take a holiday or need to take time-out for any other reason, the business cannot produce a profit. Also, in periods of economic downturns, where the demand for a product or service may be reduced, the sole-trader can find themselves in periods of zero earnings.

A person is self–employed if they run their business for themselves and take responsibility for its success or failure.

Main Types of Business Structures (UK)

Type of Business Structure |

Description of Business |

| Sole Trader | The exclusive owner of a business, entitled to all profits after tax, but equally responsible for all debts. A sole trader can employ staff but remains the sole owner of the business. This is the simplest business structure to set up13. |

| Limited Company | A private company whose finances are separate from the owner’s personal finances. As a Director of the business, the owner pays Corporation tax14. Profit after tax can be distributed to shareholders as dividends15. Ltd companies are, on a whole, more tax-efficient16. |

| Partnership | A Partnership is whereby 2 or more self-employed people run a business together. All business profit & losses are shared. Each partner is liable for another partner’s negligence or misconduct17. The partnership is personally responsible for all matters regarding the business. |

| Limited Liability Partnership (LLP) | An LLP is a business partnership whereby said partners have limited liabilities, much like a Limited Company. Each member pays tax on their share of the profit but they are not personally liable for business debt18. There is no liability for another partner’s negligence or misconduct. |

Which Business Structure is recommended for the Self-Employed Optician?

If an optician decides to work for themselves as a self-employed person, the main business structures to consider are ‘Sole Trader’ or ‘Limited Company’. Both have their advantages and disadvantages so ultimately the final business type will depend on the ease of setting up, profit, tax efficiency and consideration of personal liability. The latter is particularly important if your assets are jointly owned by someone who has nothing to do with the business.

Image (5) courtesy of Fool.co.uk/my wallet hero

Locum Optician: Sole Trader v’s Limited Company

Considerations for the Sole Trader:

Advantages |

Disadvantages |

| Sole-Trader is the most popular and simplest business structure. It is the ideal model for start-up businesses19. | Sole-Traders are personally accountable for profits, liabilities & legal issues. The business and personal finances are legally tied and therefore, jointly-owned personal assets are at risk20. |

| Income Tax is paid on profit. There is no Corporation Tax to be paid. All post-tax profits go to the owner. | There is no cap on profit however, this system is less tax efficient at higher profits, where the income tax band increases to 40% and over21. |

| There are no Registration fee’s | Raising extra finances can be more difficult for the Sole-Trader since banks and investors prefer Limited Companies22. |

| The business details are private and do not need to be publicly shared | Should the Sole-Trader struggle with book-keeping and the Self-Assessment process, it may be wise to use an accountant. This will increase the business expense and decrease profit |

| The Sole-Trader has full control of their entire business. | |

| If all paperwork is in order, the Self-Assessment form can be completed within a day by the business owner. Self-Assessment is done annually.

|

Considerations for a Limited Company:

Advantages |

Disadvantages |

| Limited Companies have no personal liabilities. Business & personal finances are legally separate and therefore protected23. Personal assets are not at risk. | A Limited Company has to be registered with the Government at ‘Companies House’ for a small fee.

|

| This is a tax-efficient business model which is much more beneficial at higher profit margins than ‘Sole-Trader’. This is because Corporation Tax has a lower fee at higher profits. | A Limited Company is a formal business structure that has increased volumes of administration, including VAT accounting. |

| Remuneration packages can be set up as business benefits. This can include pension schemes, company cars and gym memberships24.

|

Since this business model is slightly more complex, it is recommended that the accounts are formally managed by an accountant. The accountant may charge a higher fee for complex accounting |

| The entire business can be run by a single owner, acting as both shareholder and director25. Thus, salary, profit and dividends are paid to themselves

|

Business information is shared with the public at ‘Companies House’. This includes details about the Director and the company earnings26. |

Whilst the Limited Company only pays Corporation Tax, the Director’s salary and shareholder’s dividends are subject to Income Tax and National Insurance contributions. However, if the salary is within the ‘Personal Tax Allowance’, the Income Tax will not have to be paid27.

“Tax is a complex area with individual circumstances greatly affecting the structuring and planning required for the most efficient outcome. Family setup, level of income and stage of career are all important considerations”.

Keith Smith, GHLD Chartered Accountants

Implications of IR35

IR35 stands for ‘Inland Revenue, 35th news release of the government budget’. It was introduced in April 2000 as a measure to combat tax-avoidance by businesses. Inland Revenue has since been modified to HMRC (Her Majesty’s Revenue & Customs) but the legislation objective remains the same; an anti-tax avoidance rule, set by law.

IR35 aims to make sure that self-employed workers, particularly those who are a Limited Company, pay the same taxes as an employee of a business that does the same job and virtually the same days/hours of duty. For example, if a self-employed optician is providing the same services as the employed optician, but in the capacity of a contractor, they are essentially an employee of the business that they are serving. By contracting through a Limited Company, the self-employed person is paying fewer taxes than their employed counterpart. The HMRC will be on the lookout for this type of ‘disguised employee’28.

From April 2021, revised legislation for ‘Off-Payroll Working rules (IR35)’ will come into effect. This means that the tax status of the self-employed person will be assessed by the business that hires the contractor. Should IR35 rules apply to the self-employed person, they will have to pay the correct taxes, and the employer may be responsible for these deductions29. As an optician, if your employer provides your testing equipment, you are likely to be within IR35.

Ultimately, the people affected by IR35 are the contractors, any agencies and the end client business. The end-client must assess whether the contractor’s employment type is that of a ‘disguised employee’. Traditionally, the employment status would be declared to the HMRC by the self-employed person, but from April 2021, the employer will determine the employment status30. A critique of IR35 is that it dismisses the fact that the freelancer works on short-term contracts and does not have a steady income.

Current Affairs – The Impact of Coronavirus

Due to the novel coronavirus pandemic, the UK Government, along with all heads of nations, have had to introduce measures to help mitigate the economic downfall caused by the large-scale closures of businesses. To stop the spread of the virus, businesses had to close their doors or work under severely controlled measures. As a consequence, many companies and self-employed traders found themselves out of work and with zero earnings.

The UK Government implemented various relief measures to help businesses. Some of the relief efforts include grants offered to self-employed individuals and loan schemes for larger businesses that have to protect their staff as well as goods.

This pandemic has highlighted how important Government funding is during periods of emergency support. Whilst some people continuously find faults with fiscal policies, we shouldn’t dismiss that the emergency funds, community aid, hospital care and covid vaccinations were all founded under extreme pressure during one of history’s most uncertain times.

Get advice from an Accountant

Tracking income and expenses for a business can be a time-consuming and demanding task. To ensure compliance with financial authorities, it may be best to employ the services of an accountant. The accountant is the money-expert. Their main purpose is to ensure that all matters pertaining to tax and profit, are accounted for legitimately.

The accountant will charge a fee for their services. However, this fee is offset by the benefits that they offer the business. An accountant has the most comprehensive knowledge regarding accounts and thus maximising profit, reducing the deficit and freeing up the business owners valuable time. As a business grows, money management should be designated to the most qualified person to do so; the accountant.

“We at GHLD are happy to offer an initial no-obligation meeting and discussion of your current and future position to see how we may assist you”.

Keith Smith, GHLD Chartered Accountants

Tax Evasion is a Criminal Offence

Tax evasion is the deliberate action to avoid paying owed taxes, to the HMRC, by individuals, businesses and trusts. Tax evasion is a legal offence that can result in financial penalties, criminal charges and imprisonment31.

Keith Smith is a Chartered Accountant and a valued member of our panel of Oodo Experts. Click here to learn more about Keith and what he can do for your business.

References –

-

https://www.moneysavingexpert.com/banking/tax-rates/ National Insurance is separate to Income Tax

-

https://www.ionos.co.uk/startupguide/grow-your-business/types-of-taxes-in-the-uk/

-

https://www.citizensadvice.org.uk/debt-and-money/tax/income-tax-how-much-should-you-pay/income-tax-rates/

-

https://www.gov.uk/income-tax-rates/income-over-100000

-

https://www.parliament.uk/about/living-heritage/transformingsociety/private-lives/taxation/overview/whytaxes/

-

https://www.citizensadvice.org.uk/debt-and-money/tax/how-to-pay-income-tax/the-pay-as-you-earn-paye-system/

-

https://www.gov.uk/tax-codes/emergency-tax-codes

-

https://www.gov.uk/national-insurance-rates-letters

-

https://www.gov.uk/tax-company-benefits/tax-on-company-cars

-

https://www.ridgefieldconsulting.co.uk/advice-and-news/tax-benefits-in-kind/

-

https://www.gov.uk/self-assessment-tax-returns

-

https://www.investopedia.com/terms/b/business.asp

-

https://www.hiscox.co.uk/business-insurance/faq/what-is-the-difference-between-self-employed-and-sole-traders

-

https://www.gov.uk/running-a-limited-company

-

https://www.wellersaccountants.co.uk/blog/what-are-the-different-types-of-business-structures-in-the-uk

-

https://www.simplybusiness.co.uk/knowledge/articles/2020/06/difference-between-a-sole-trader-and-a-limited-company/

-

https://www.wellersaccountants.co.uk/blog/what-are-the-different-types-of-business-structures-in-the-uk

-

https://www.gov.uk/guidance/set-up-and-run-a-limited-liability-partnership-llp

-

https://www.unbiased.co.uk/life/small-business/business-structure

-

https://www.wellersaccountants.co.uk/blog/what-are-the-different-types-of-business-structures-in-the-uk

-

https://www.wellersaccountants.co.uk/blog/what-are-the-different-types-of-business-structures-in-the-uk

-

https://www.simplybusiness.co.uk/knowledge/articles/2020/06/difference-between-a-sole-trader-and-a-limited-company/

-

https://www.unbiased.co.uk/life/small-business/business-structure

-

https://www.wellersaccountants.co.uk/blog/what-are-the-different-types-of-business-structures-in-the-uk

-

https://www.hiscox.co.uk/business-insurance/faq/what-is-the-difference-between-self-employed-and-sole-traders

-

https://www.simplybusiness.co.uk/knowledge/articles/2020/06/difference-between-a-sole-trader-and-a-limited-company/

-

https://www.gov.uk/running-a-limited-company/taking-money-out-of-a-limited-company

-

https://www.theaccountancy.co.uk/ir35/who-is-affected-by-ir35-legislation-2558.html

-

https://www.gov.uk/government/publications/off-payroll-working-rules-communication-resources/know-the-facts-for-contractors-off-payroll-working-rules-ir35

-

https://www.brooksonone.co.uk/blog/most-searched-ir35-questions-answered/

-

https://www.gov.uk/topic/dealing-with-hmrc/tax-avoidance

Posts by Oodo may include affiliate links. This means that we make a small commission from referrals and purchases at no extra cost to you. Thank you for your kind support.